伦敦金对美元的英文代码

来源于:本站

发布日期:2025-09-28 09:37:13

### London Gold to USD: A Precious Investment Journey

In the world of investments, few assets shine as brightly as gold. As a safe haven during economic uncertainties, gold has long been a go-to choice for investors. Today, let’s dive into the fascinating relationship between London Gold and the US Dollar, and why savvy investors are keeping a close eye on this dynamic duo.

#### Understanding London Gold

London Gold refers to the gold traded in the London bullion market, which is one of the most influential gold trading markets globally. The price of gold in London is often considered the benchmark for gold prices worldwide. It’s where central banks, financial institutions, and individual investors converge to trade this precious metal, making it a critical player in the global economy.

#### The Gold and USD Connection

The relationship between gold and the US Dollar is intricate. Generally, gold is priced in dollars, which means that when the dollar strengthens, gold prices tend to weaken, and vice versa. This inverse relationship can be attributed to a few key factors:

1. **Inflation Hedge:** Gold is often seen as a hedge against inflation. When the dollar loses value due to inflation, investors flock to gold, driving its price up. Conversely, a strong dollar can signal low inflation, leading to decreased demand for gold.

2. **Safe Haven Appeal:** In times of economic instability or geopolitical tensions, investors often seek refuge in gold. If the dollar weakens during such times, gold prices can spike as people rush to secure their wealth.

3. **Interest Rates:** The Federal Reserve’s interest rate policies play a significant role in the gold-USD dynamic. Lower interest rates can lead to a weaker dollar, making gold more attractive as an investment since it doesn’t yield interest. Conversely, higher rates can strengthen the dollar and negatively impact gold prices.

#### The Current Landscape

As of late 2023, investors are navigating a complex landscape influenced by various global events, including inflation concerns and geopolitical tensions. The Federal Reserve’s monetary policy decisions are closely watched, as they can significantly impact both the dollar and gold prices.

For instance, if the Fed decides to maintain low interest rates to stimulate growth, we may see gold prices rise as investors look for alternative assets. On the other hand, if inflation stabilizes and the Fed signals an increase in rates, the dollar may strengthen, potentially leading to a decrease in gold prices.

#### Tips for Investing in London Gold

If you’re considering investing in London Gold, here are a few tips to keep in mind:

1. **Stay Informed:** Keep an eye on economic indicators, interest rates, and geopolitical events that could impact the dollar and gold prices. Knowledge is power, especially in the world of investments.

2. **Diversify Your Portfolio:** While gold can be a great addition to your investment portfolio, it’s essential to maintain a diversified approach. Don’t put all your eggs in one basket; consider a mix of assets to mitigate risk.

3. **Choose the Right Investment Vehicle:** You can invest in physical gold, gold ETFs, or gold mining stocks. Each option has its pros and cons, so choose one that aligns with your investment goals and risk tolerance.

4. **Long-Term Perspective:** Gold is often viewed as a long-term investment. While prices may fluctuate in the short term, history shows that gold can retain its value over the long haul.

#### Conclusion

The interplay between London Gold and the US Dollar is a captivating aspect of the financial world. For investors, understanding this relationship is crucial in making informed decisions. As we navigate the ever-changing economic landscape, gold remains a shining beacon for those looking to safeguard their wealth. Whether you’re a seasoned investor or just starting out, keeping an eye on this precious metal can be a rewarding endeavor. Happy investing!

温馨提示:本站所有文章来源于网络整理,目的在于知识了解,文章内容与本网站立场无关,不对您构成任何投资操作,风险 自担。本站不保证该信息(包括但不限于文字、数据、图表)全部或者部分内容的准确性、真实性、完整性、原创性。相关信 息并未经过本网站证实。

文章标签: 无

分享到

伦敦金投资

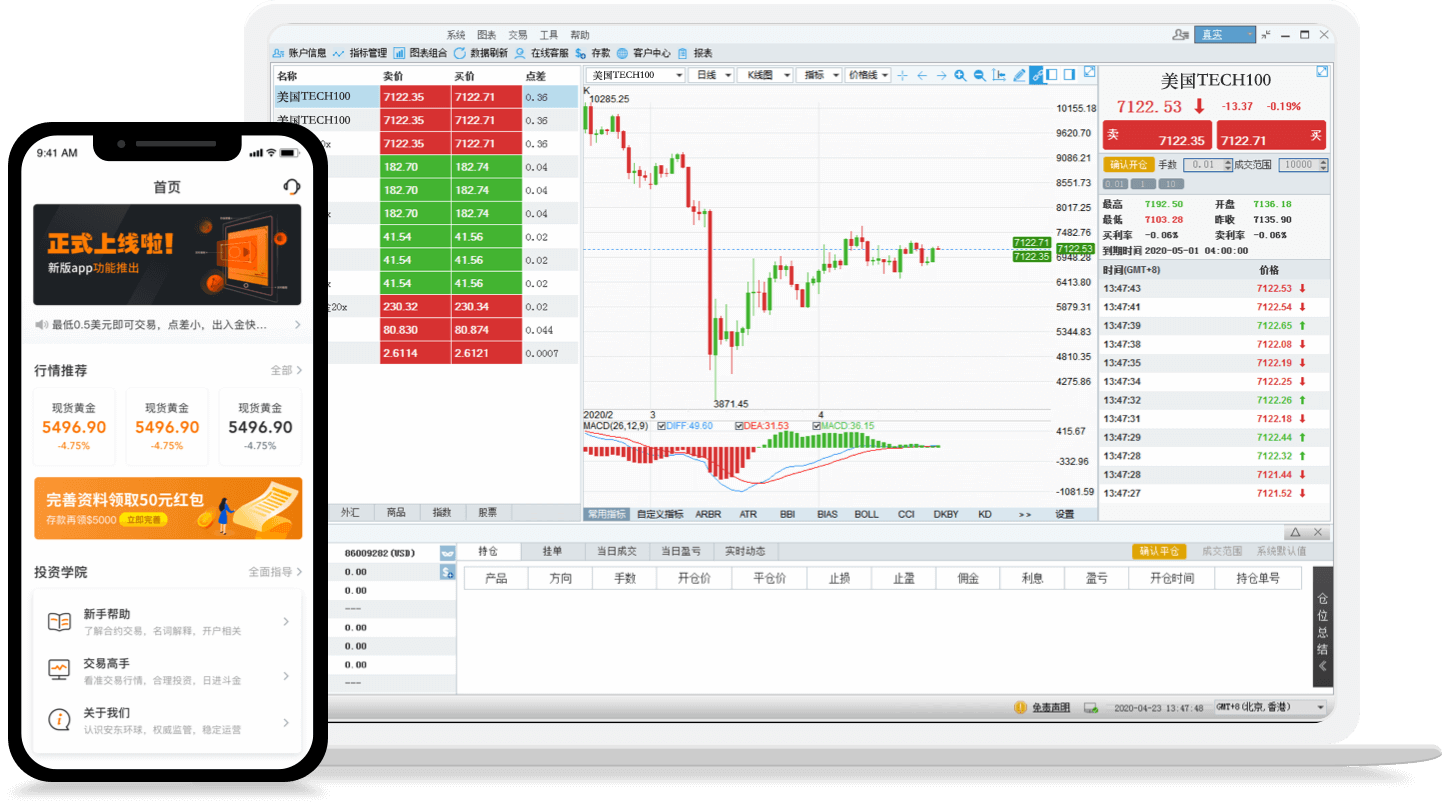

带您了解伦敦金怎么投资开户流程、操作技巧、交易策略知识,哪个平台投资门槛低/资金安全/口碑比较好?欢迎来美建金业!

2026-02-04

2026-02-04

2026-02-04

2026-02-04

2026-02-04

2026-02-03

2026-02-03

2026-02-03

2026-02-03

2026-02-03

2026-02-03

2026-02-03

热门排行

栏目热文

- 2 伦敦金怎么开户港伦敦金

- 3 伦敦金下午定盘价是几点

- 4 伦敦金杠杆一般多少利息

- 5 伦敦金交易平台如何操作

- 6 抄伦敦金能挣100万吗

- 7 伦敦金账户入金窗口在哪

- 8 一手伦敦金期货盈利多少

- 9 同花顺上的伦敦金靠谱吗

- 10 什么app可以买伦敦金